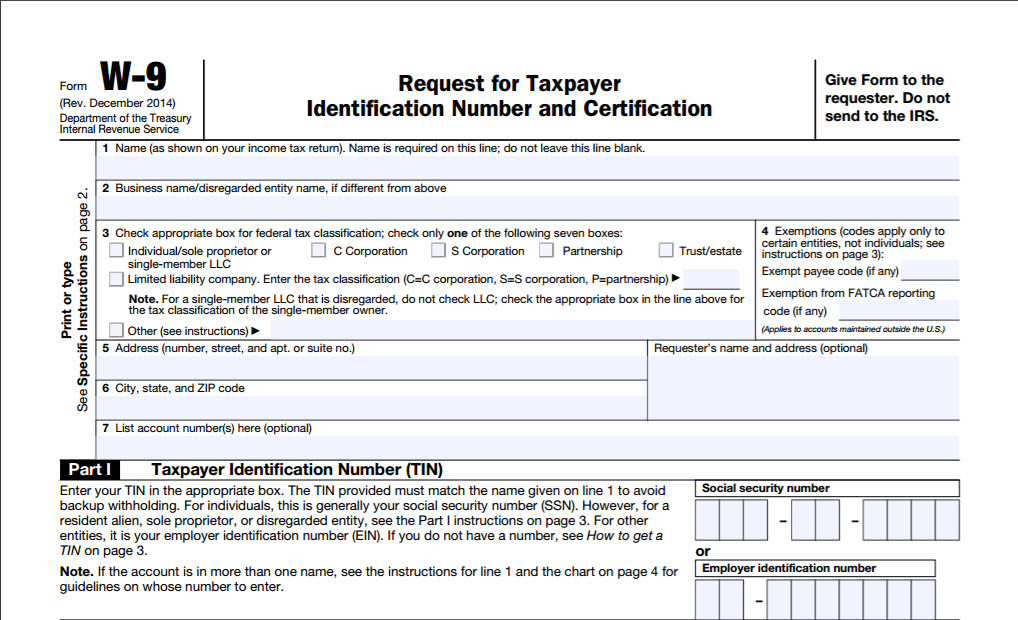

W 9 Form 2025 Free - When free file fillable forms closes after october 20, 2025, you will not be able to access your account to efile, print or review your information. W4 Form 2025 State Sybil Kimberlyn, The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b. If you receive an email saying your return was rejected, you must correct any errors and resubmit your return before october 21, 2025.

When free file fillable forms closes after october 20, 2025, you will not be able to access your account to efile, print or review your information.

2025 W 9 Printable Form Bel Fidelia, The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b. When free file fillable forms closes after october 20, 2025, you will not be able to access your account to efile, print or review your information.

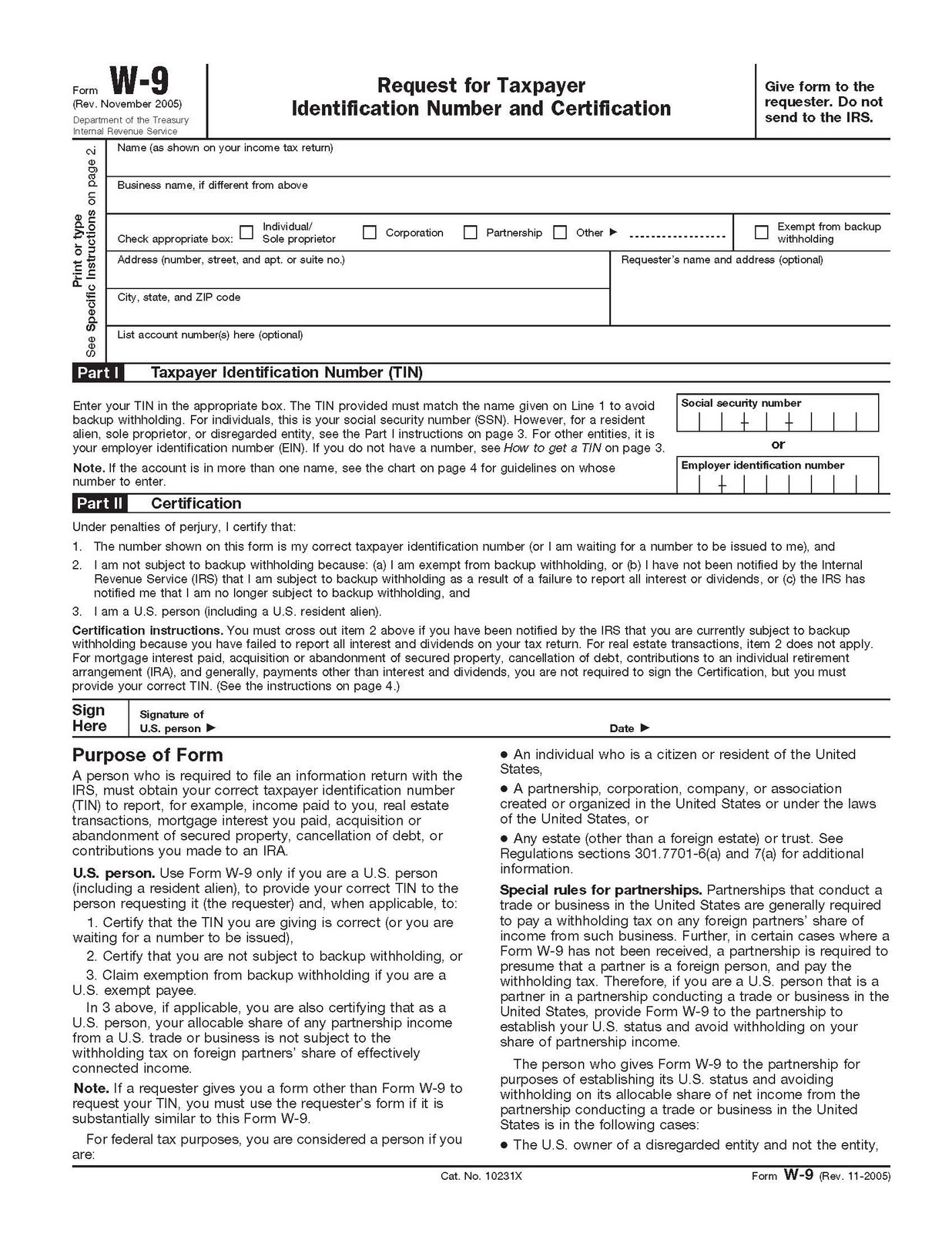

Printable W9 Form For Employees, When free file fillable forms closes after october 20, 2025, you will not be able to access your account to efile, print or review your information. The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b.

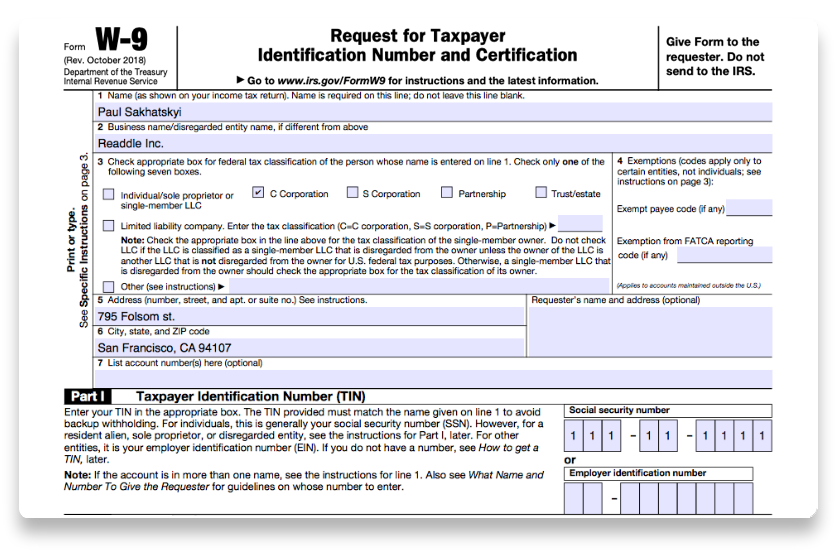

Free Irs Form W9 Printable Printable Forms Free Online, Independent contractors who were paid at least $600 during the year need to fill out a. It is essential for completing form 1099 and is particularly relevant for independent contractors, freelancers, and unrelated vendors.

I 9 2025 Printable Form Dre Ofelia, That’s a standard request for ensuring federal tax compliance. Start free file fillable forms.

How to fill out IRS Form W9 20252025 PDF Expert, It is essential for completing form 1099 and is particularly relevant for independent contractors, freelancers, and unrelated vendors. Independent contractors who were paid at least $600 during the year need to fill out a.

This blog will give you an overview as well as insight into how this may affect your business’s compliance process moving forward.

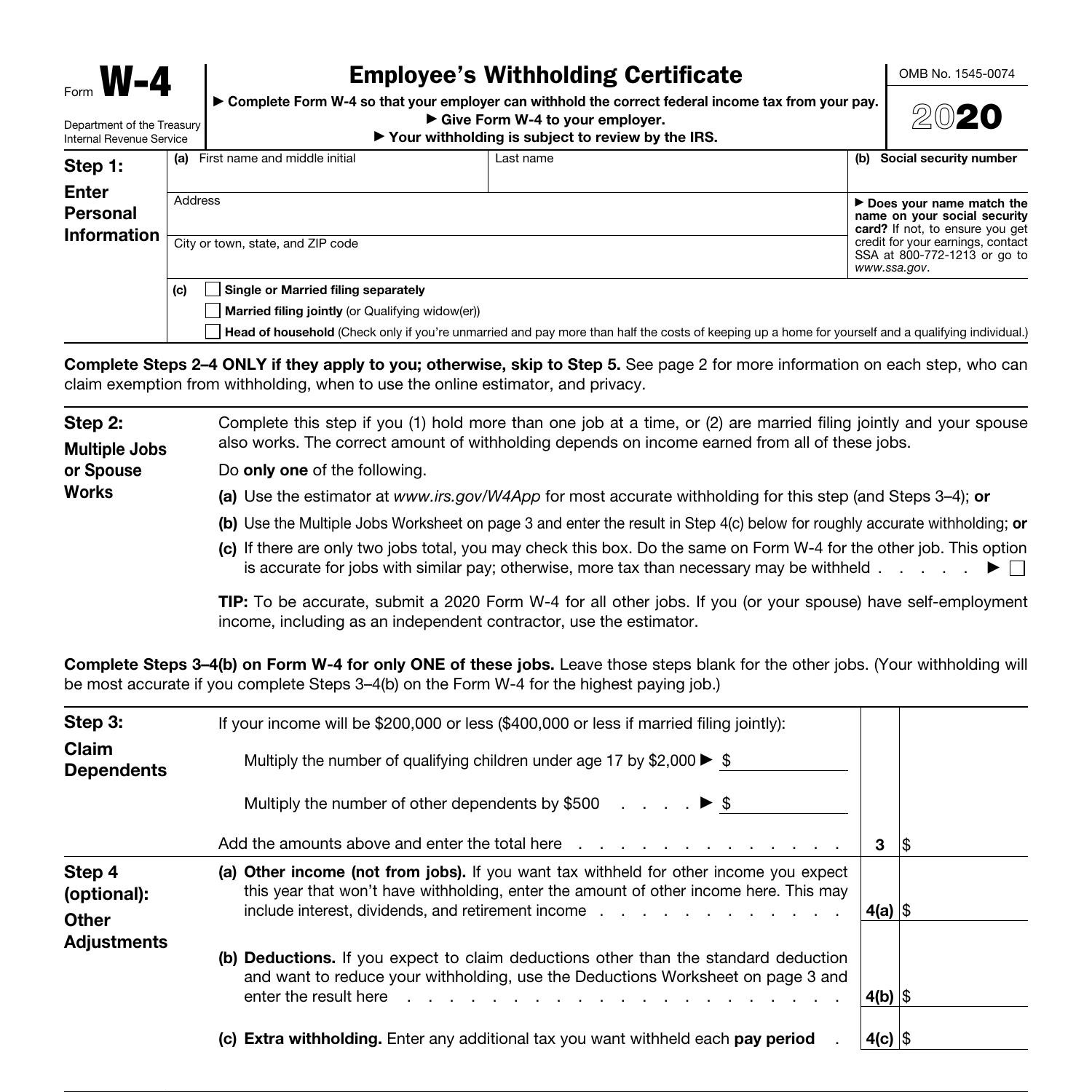

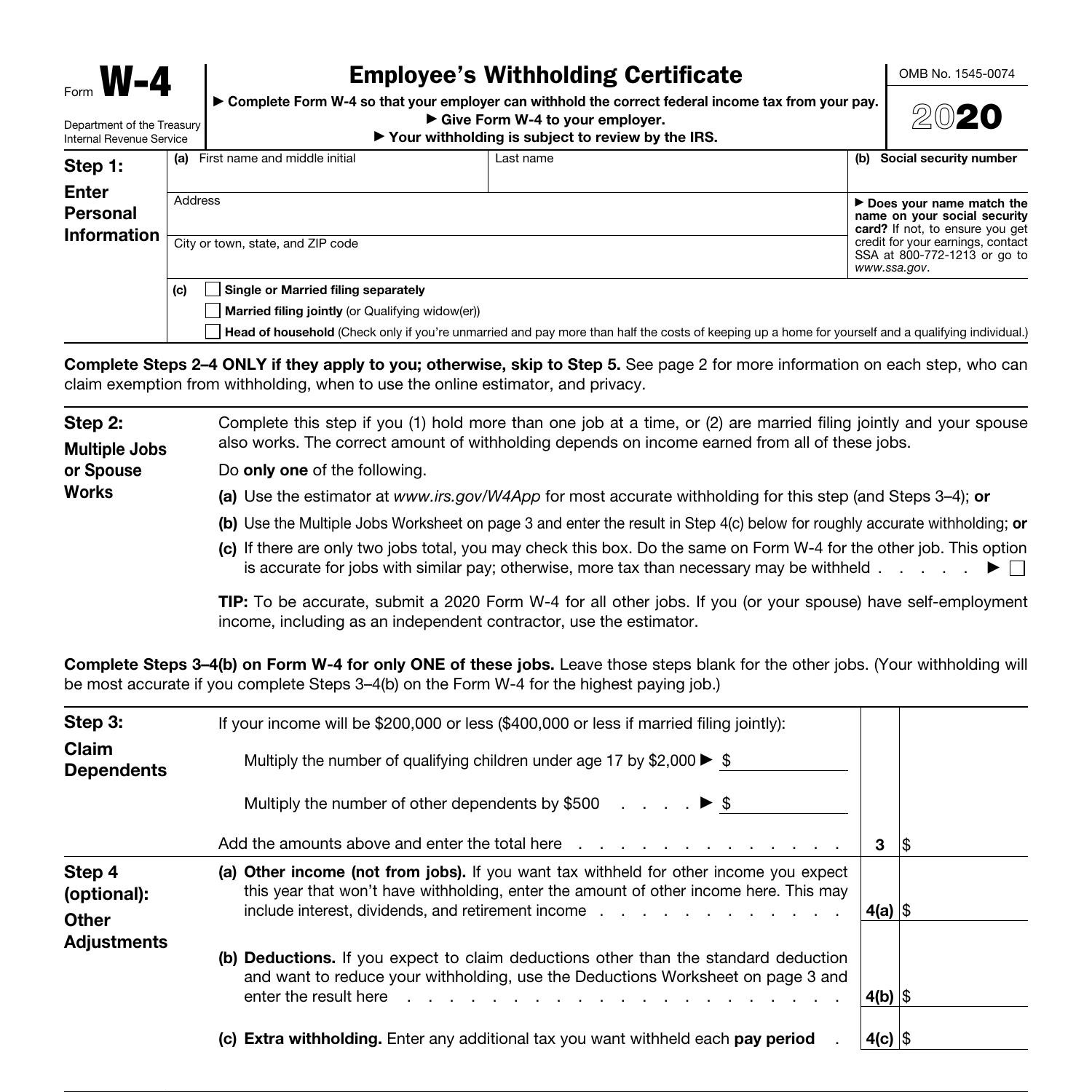

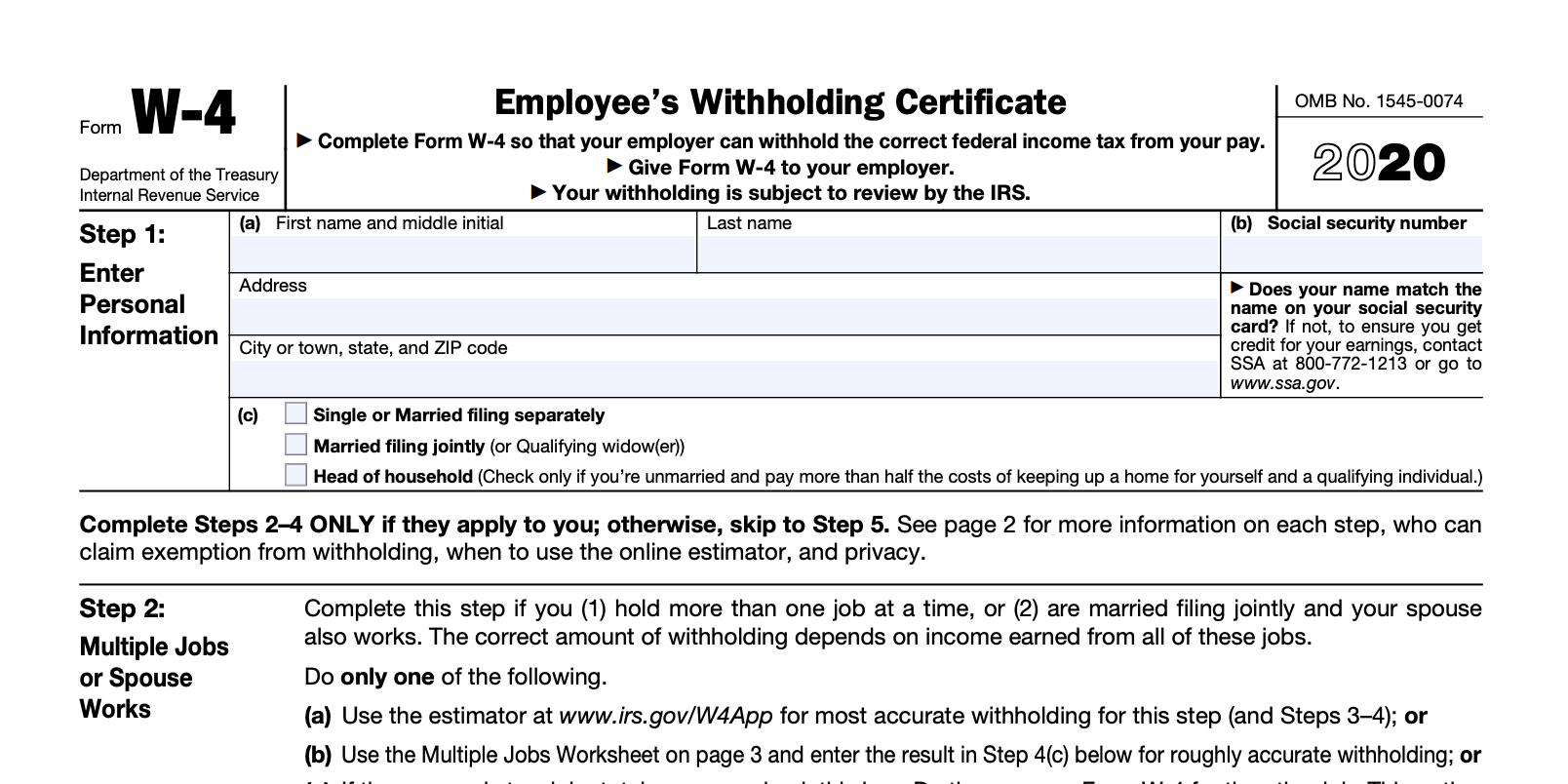

Comprovante De Rendimentos 2023 W4 Irs Form IMAGESEE, This blog will give you an overview as well as insight into how this may affect your business’s compliance process moving forward. The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b.

Download a free w9 form. If you receive an email saying your return was rejected, you must correct any errors and resubmit your return before october 21, 2025.

The 2025 version replaces the version that was previously published by the irs in 2025.

W 9 Form 2025 Free. Download a free w9 form. The original line 3—federal tax classification has now been split into two sections, line 3a and line 3b.